February 2015

10

S

afety

& S

ecurity

with an STA2062 multimedia processor that

handles the telematics. If danger is identified,

the driver is immediately warned to take steps

to avoid an accident. Cohda Wireless says its

technology extends driver awareness beyond

buildings that block the driver’s view, enabling

drivers to be aware of all threats.

The European Union (EU) is taking a lead-

ing role in moving the connected car from

concept to reality. Earlier this year the EU

announced that the basic set of standards to

make connected cars a reality has been fully

completed. These standards ensure that vehi-

cles made by different manufacturers will be

able to communicate with each other. The EU

says that connected cars will appear on the

continent’s roads in 2015. By then, all new

cars are expected to have built-in technol-

ogy that will allow them to automatically call

emergency services if the worst happens. If

the occupants are not conscious, the technol-

ogy will provide the vehicle location to emer-

gency services. The system will also convey

vital information to the emergency services.

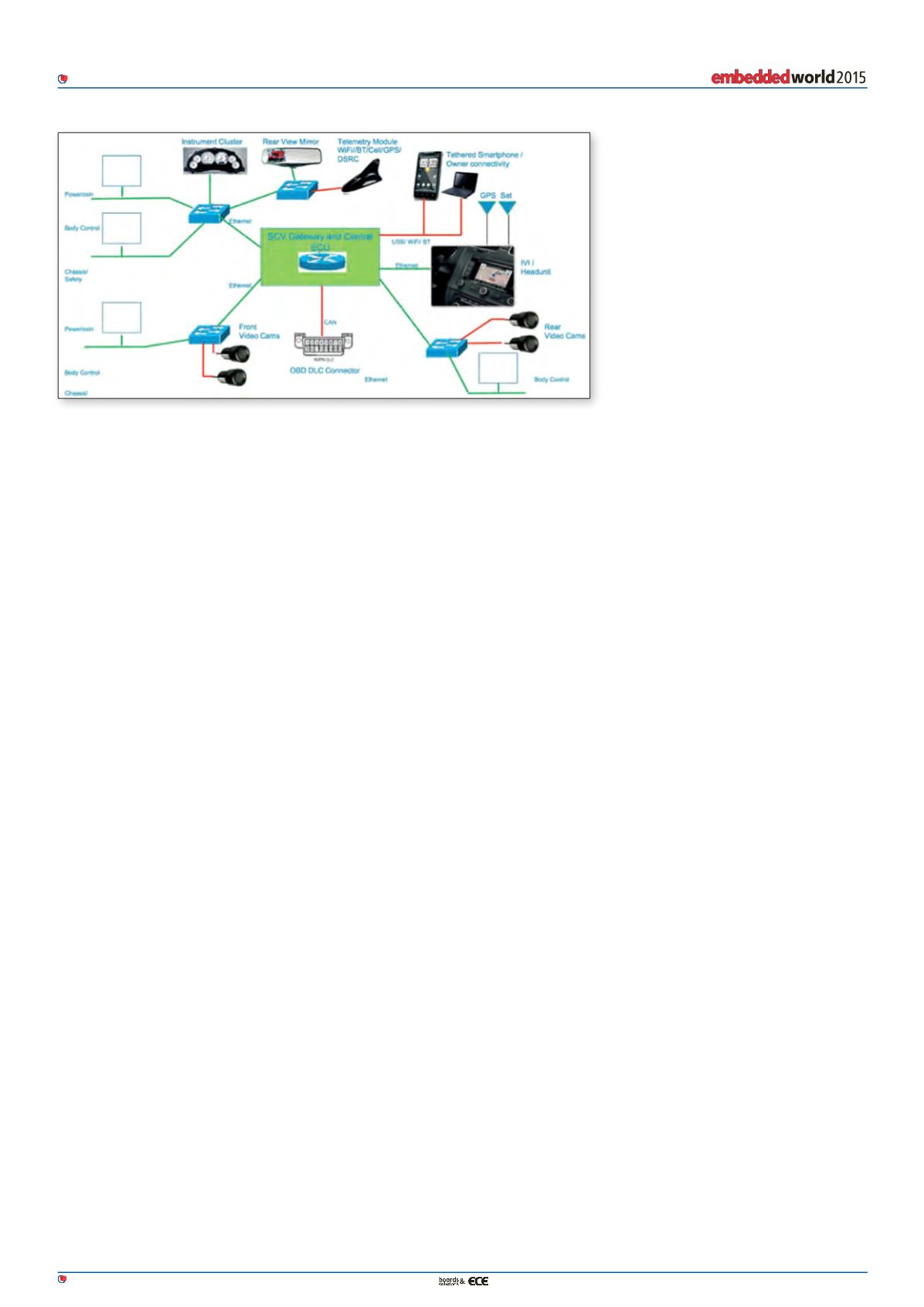

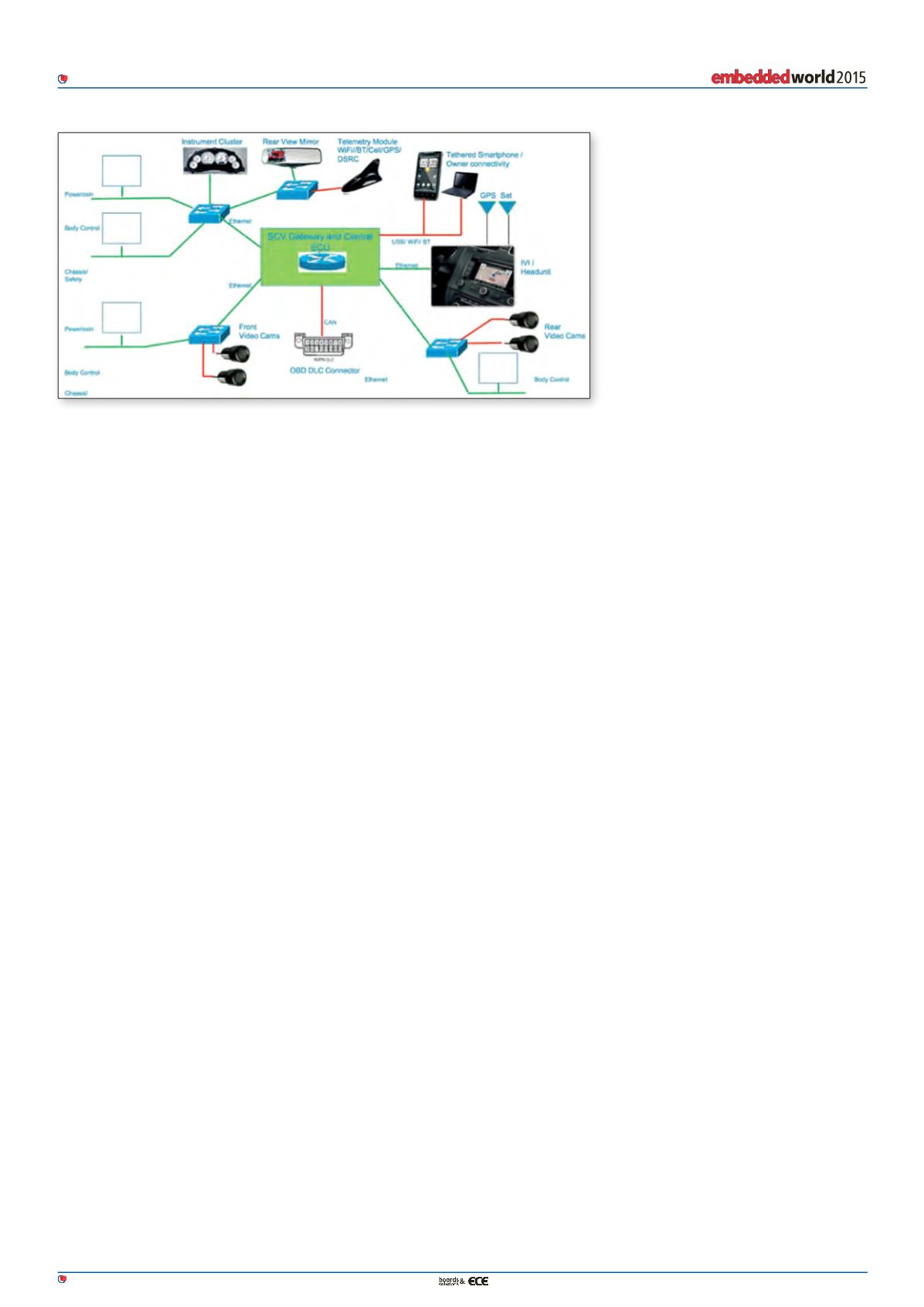

At first glance the inside of the future con-

nected car won’t appear too different from

vehicles nowadays. A large human machine

interface (HMI) will likely dominate the

dash in a similar way to those in contempo-

rary high-end vehicles. And because a mod-

ern car already contains a lot of networked

electronics with proven reliability (and ben-

efiting from commodity pricing beloved of a

sector that looks to continually drive down

costs), much of that technology will remain

yet be adapted to suit connection to the IoT.

However, the adaptation required could be

considerable. Modern vehicles encompass

sophisticated networks formed from wired

and wireless elements. Electronic control

units (ECUs) - that power everything from

dashboard instruments to safety features and

powertrain components to in-vehicle info-

tainment (IVI) systems - form a key part of

these networks. The number of these devices

in the average car has doubled in the past ten

years, and many vehicles now incorporate

more than 125 separate ECUs. Today cars also

boast a swarm of sensors monitoring every-

thing from road condition, distance to the

vehicle in front, vehicle speed and accelera-

tion, and location (via GPS) to internal tem-

perature, seatbelt tension and driver alertness.

Wireless connectivity such as Bluetooth tech-

nology or Wi-Fi is typically used to connect

smartphones and tablets to the vehicle dash-

mounted HMI. Most of the other sensors in

the contemporary car, like those monitoring

powertrain, chassis, body, control and safety

use wired Controller Area Network (CAN)

or Local Interconnect Network (LIN) buses.

The instrument cluster is also connected via a

CAN bus to the network. All network connec-

tions terminate at a central gateway that super-

vises functions and can be accessed from an

external computer via an on-board diagnos-

tics data link connector (OBD DLC). Changes

to this conventional layout in an IoT-enabled

vehicle are likely to include the use of Ether-

net to link the various systems replacing CAN

and LIN buses (particularly as Ethernet has

recently been embraced by several automo-

tive OEMs for vehicle infotainment buses)

and the introduction of mini-hubs to aggre-

gate groups of sensors or ECUs to simplify the

network. Everything will still connect back to

a central-vehicle gateway that will retain the

OBD DLC, but vehicles will also incorporate

a telemetry module to look after the wireless

connectivity to the internet (“The Smart and

Connected Vehicle and the Internet of Things,”

Flavio Bonomi, Cisco Systems, 201).

While the car itself may form a thing on the

internet, the various systems and subsystems

will generate the information that will be of

most value to the IoT. A good way to con-

sider vehicle IoT connectivity is to consider

the car as a large hub to which all the systems

and subsystems of the vehicle link in order

to send and receive information to the wider

network. Today, the computational power and

intelligence required to take the raw data from

systems in the car, send it in a form that’s use-

ful to external servers, and then receive and

disseminate information coming back, resides

in the central vehicle gateway. But in the near

future automotive sensors could include tech-

nology that will allow communication directly

to servers in the cloud using the gateway sim-

ply as a dumb forwarding device. Software

such as Bluetooth v4.1 (which includes a low-

power variant Bluetooth low energy suitable

for wireless sensors) already includes foun-

dation technology that will lead to wireless

sensors with their own IP addresses commu-

nicating directly with remote devices on the

internet. Companies such as STMicroelec-

tronics, Texas Instruments and Nordic Semi-

conductor are pioneers in this field.

Electronics manufacturers have identified the

automotive segment as a lucrative opportunity

for their IoT products. But it is early days for

the technology and automotive-grade com-

ponents are thin on the ground. Nonetheless,

Intel is encouraging automotive engineers

to experiment with IoT with the introduc-

tion of its In-Vehicle Solutions Development

Kit based on the CM1050 high-performance

compute module. The company claims the kit

simplifies in-vehicle system design. Intel has

also formed an Internet of Things Solutions

Alliance with companies such as Altera, Arbor

and Greenliant in order to increase momen-

tum. And Texas Instruments is working hard

to exploit automotive IoT with its WiLink

8Q solutions. The company says the WiLink

8Q automotive wireless connectivity family

offers scalability across multiple technologies

to deliver features such as in-car multimedia

streaming video in parallel with Bluetooth

technology hands-free calling and naviga-

tion via GPS. Freescale Semiconductor is also

backing automotive IoT, putting its focus on

Linux and Android operating systems as the

basis of future vehicle software and suggest-

ing the i.MX family of automotive application

processors are a good solution for vehicle net-

work applications.

The IoT promises to improve the driving expe-

rience and save lives. However, in order to fully

unlock this potential, a wide range of barriers

need to be addressed, including security, safety,

regulation, lack of cross-industry standards,

widely varying industry dynamics and life

cycles, and limited initial addressable market

sizes. So while the future for the connected car

is undoubtedly bright, the highway to its intro-

duction is covered with speed bumps.

n

For further information visit the Application

&

Technology section of mouser.com

Figure 4: Future vehicle network with Ethernet-based central-vehicle gateway and mini-hubs.

(source: Cisco Systems.)